Wills, Trusts, Guardianship, Conservatorship, & Probate

LEHNER LAW OFFICE A Limited Liability Company

Estate Planning

This is a very big subject. To help provide basic information and avoid confusion, we have broken this down in to important subtopics:

General Trusts and Wills

Choosing a Trustee

Powers of Attorney

Health Care Directives ("Living Wills")

Guardianship for minors

Estate & Gift Taxes

Special Trusts for Special People: Supplemental Needs Trusts

General Trusts and Wills

Putting aside tax issues for a moment, this article is designed to give you an overview of the purpose of trusts and wills and the differences between the two.

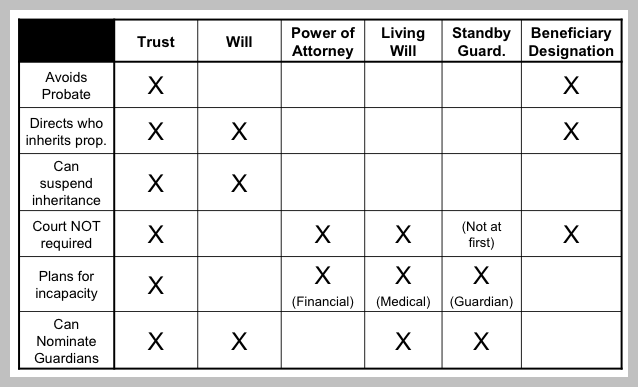

The general purpose of a trust or a will is to determine in advance of death who will receive your assets when you die, when under what circumstances, and who will be in charge of that whole process. Both a will or a trust can be drafted that will accomplish those goals. They are different in they procedure that is used, but both will have the same outcome. Both can deal with any tax issues you may have (see Estate & Gift Taxes below). Neither a will nor a general trust have any tax advantage over the other. There are important differences, however.

Probate is a legal process that must be used when a person dies owning property in their own name, if there are no named beneficiaries surviving, no joint owner, or no private legal contract for the transfer of assets or benefits. Assets that don't have to go through probate include such things as:

· Life Insurance or annuities with named, surviving beneficiaries

· "Pay On Death" bank accounts with named, surviving beneficiaries

· "Transfer On Death" securities with named, surviving beneficiaries

· Jointly owned assets with "rights of survivorship" and a surviving owner.

For these assets, neither a trust nor a will is required in order to transfer rightful ownership upon your death. However, if you became mentally incapacitated, there are problems that those types of ownership will not help and neither will a will. (See Powers of Attorney) But when you have general trust holding your assets, they will usually take care of such problems.

For assets that aren't like these, where the only owner is you and there is no beneficiary or no private legal contract for transfer, probate will be required.

Probate is the legal process through which rightful ownership is determined after the death of the owner where there is no joint owner who has rights of survivorship, or where there is no beneficiary, or no private legal contract for transfer that was put in place before the owner died. Probate is the process of determining who is entitled to those assets. It involves the courts system and usually involves lawyers. It is lengthy and it is costly.

A will does not avoid probate. A will allows you to state who should receive your estate, but its validity and interpretation still requires the probate system. It cannot be used for any purpose before you die, so it does nothing to help in the event of incapacity.

Trusts avoid probate because the creation of a trust creates a new legal "entity" which can actually own assets. A trust is not mortal, like people, so if everything you own is transferred to your new trust, the new owner (your trust) will never die. Therefore, probate is not required. You own your trust and are in complete and exclusive control of it while you are alive and able, so you still have total control and use of everything. If you become mentally incapacitated or die, the trust document should say who takes over from there - someone you picked. After you death, the trust determines who gets all the estate assets. All of this can be done without probate, so there are usually no court costs and the legal fees are greatly reduced. It can go much faster than probate as well.

The type of trusts which we are talking about here are general trusts which are usually called "revocable trusts" or sometimes called "living trusts".

While you are alive, able and acting as your own trustee, these trusts have no tax consequences, good or bad. You do not need a separate tax ID number and you don't have to file your taxes any differently. If you need some type of tax planning, that can be added to your trust, in the same way it can be added to a will.

Choosing A Trustee

Among the important decisions you should make as part of your estate planning, one of the most important is selecting who should serve as trustee in the event you create a trust for the benefit of another person. In order to better understand how to pick who should be your trustee, it is a good idea to understand the role that they play and the different terms that are used.

Powers of Attorney

Powers of attorney are used to plan for situations where you are unavailable to authorize financial transactions or to gain access to information or make decisions. Being "unavailable" includes times when you might be away and unreachable, such as people in international business, missionaries and people in the military, but most commonly it is about times when you are mentally incapacitated. Things can happen, such as illness or accident, which leave you unable to make decisions or authorize things.

That "unavailability" or incapacity might be temporary or it might be "indefinite" or permanent. In either case, it can happen and usually it is unexpected. By planning ahead and signing a power of attorney in advance of such problems, you can authorize others to act on your behalf.

When you give someone authority under a power of attorney, you give authority but you don't give up any. You maintain your own authority, but share that with someone you trust, in order to allow them to help you take care of things when you need help.

Regardless of your age or health, you should have powers of attorney. Even if the odds of needing one are low, the downside of not having one if it was ever needed is really serious. Sometimes, people have to have probate proceedings even before they have died, because they made no plans for incapacity.

Powers of attorney generally refer to issues surrounding property, business, assets, income and all manner of financial issues, including the ever-growing issues about access to information. For medical issues and personal care, Minnesota requires a separate type of power of attorney, called:

Health Care Directives

Health Care Directives (sometimes called a "living will") are powers of attorney regarding medical decisions and regarding access to medical information. A person can name someone to act or decide things regarding medical care if they use the correct legal form. This form should also be used to authorize access to medical information, especially in light of the new "HIPAA" privacy laws.

In addition, Health Care Directives can be used so that you can state your views, in advance, with regard to medical care issues. These are often referred to by medical people as "advance directives." For example, you can state what you would or would not want to happen in the event you are terminally ill and unable to make decisions and a medical procedure needs to be considered, such as tube feeding or CPR (Cardiopulmonary resuscitation). You can get into as much detail as you want and you can also make very general statements. When you do, the person you name must comply with your instructions and medical people must also try to comply with your instructions, within the bounds of what is considered normal medical practices.

Today, with new laws ever tightening restrictions on giving out medical information to persons other than the patient, even immediate family members may be faced with medical records which cannot be disclosed because of these laws. Having a Health Care Directive in place which includes proper information release authorization is becoming more and more critical.

Regardless of your age or health, you should have a valid and current Health Care Directive in place.

Guardianship for Minors

People who have minor children need to provide for who would have custody of them in the event the parent or the custodial relative died. If the child has another surviving parent whose parental rights have not been terminated, that person still has the first priority to seek custody of their own child. Minors who are over 14 also have a say in the selection process. Minors who have been legally emancipated are their own legal guardians.

But most of the time, this is the most important issue a parent can consider. The parent has the right to nominate their own replacement, a guardian, in the event that parent is unavailable, incapacitated or deceased. There are a number of ways to do this. Although the courts system has the ultimate authority to determine who ought to be appointed guardian, parents have the right to nominate and, by and large, the person they nominate is the most likely to be appointed (unless of course the person nominated is somehow unfit for that duty).

The most common way of nominating a guardian for a minor, is by including a provision in your will for that purpose. It can also be put in a trust, if the trust is properly executed, but we recommend the will as the best method.

Temporary guardianship can be given by a separate document and powers of attorney to take care of minor children in the absence of a parent temporarily can be given by separate forms as well.

A Delegated Parent Contract can also be obtained and, oddly enough, it can be noted on your driver's license that you have one, much in the same way that your license can show if you are an organ donor. This Delegated Parent Contract is actually a guardianship appointment. It gives your selected friend or family member immediate right to custody if you died and lasts for a year, giving them more than enough time to obtain judicial appointment of a permanent guardian. This form can be obtained from the Minnesota Department of Transportation and is easy to fill out. You can get them wherever you renew your license or get car license plate tabs. The cost to add a note to your license is small.

Estate Taxes

Estate taxes are taxes levied on the estate of a person who has died. Some states have “inheritance taxes”, which is tax payable by the recipient of an inheritance. Under Minnesota law and Federal law, there is no inheritance tax, because the taxes are levied upon the estate before the recipients of the inheritance ever receive their portion of the estate. The tax is determined by the total size of the estate. There are complex rules regarding what is included in the estate and what is not.

Special Trusts for Special People: Supplemental Needs Trusts

Sometimes people with disabilities inherit an estate or receive money from settlements, lawsuits, or receive other windfalls which makes a radical change in their personal net worth. If the person with the disability has medical issues or needs supervised care, sometimes their expenses can be so great that any such windfall they might receive would be quickly spent. Often, these people are already receiving governmental programs for their medical care, or they are very likely to need them in the future. Even children, whose disabilities mean that they are likely to need that type of expensive institutionalization, medical care or other services, run the risk of losing any inheritance or windfall they might receive.

The content of this website is intended for informational purposes only and does not constitute legal advice, nor does it create an attorney - client relationship between the reader and the Lehner Law Office, LLC.

Lehner Law Office, LLC

1069 S. Robert Street, Ste 100

West St. Paul, MN 55118

T 651.222.9829

F 651.222.1122